How To Create A Record Of A Bounced Check On Quickbooks For Mac

You may encounter situations wherein you need to record bounced checks and new customer payments. The outlined steps in this article will help you record these kinds of transaction. Enter the Returned Check with Write Check • Select the Plus icon (+) at the top. • Under Vendors, choose Check.

When the amount is paid, receive the as usual.

Alicia Katz Pollock Royalwise.com 971-235-7119 3 Bounced Checks - Customers When a Customer's Check Bounces Set up #1: Products and Services - Create a Bounced Check Item. QuickBooks 2014 is making the accounting for returned checks (bounced, bad, or NSF) a snap. This new feature has been desired for a long time, and works very well in the accounting end of QuickBooks. Not only will it record the charge in your bank account, record the bill to the customer for the bank fee, and record the bank fee expense, but it. The fees will be taken out separately by the bank and should be recorded in QuickBooks as an EFT check (A check with EFT on the Check # Line). When we charge the customer for it, we can book that to a RDI Fee income account or as a direct offset to the fees we paid the bank. Step 1: Create two items—one for bounced checks and one for fees you charge your customer for bounced checks. (You’ll only need to do this once.) (You’ll only need to do this once.) Step 2: Use the items created in step 1 to reinvoice the customer for the bounced check, plus any bank fees you want to recover.

If you don’t know or remember the customer’s name, keep clicking the previous button until you find the bounced check. Download spotify for mac free. Upon clicking the bounced check, you’ll have the option to specify a fee charged to you for the transaction.

Be careful to double check terms and due date. This will add the amount due back to aging reports without effecting income for the current period. It also eliminates any confusion as to how to record the receive payment when the money is received again. Simply receive it against this invoice, just like usual. Go to the and enter the fee that your bank will charge with the date the bank withdrew the funds from the account. Notice the amount of the returned check is already there.

• Go your your Items list (Lists > Items). • At the bottom, click the + button and add an item for the bounced check with these settings: • Type: Select “Other Charge.” • Item Name/Number: Enter “Bounced Check.” • Amount: Leave at “0.” • Taxable: Leave unselected. • Account: Choose your bank account (for example, Checking). • Click Next and create a second item for the fee you charge your customer for the bounced check. Use these settings: • Type: Select “Other Charge.” • Item Name/Number: Enter “Bad Check Charges.” • Amount: Leave at “0.” • Taxable: Leave unselected. • Account: Choose an income account, such as Returned Check Charges. Photo montage software for mac.

If you process enough transactions, sooner or later you’ll have to account for a returned check. A check that is returned unpaid is given many labels (such as NSF or bounced check) but the accounting treatment is the same. The procedures outlined below work effectively for POS users in both single stores and chains.

Hi, I'm Veronica Wasek. I am an Accounting Influencer, Top 10 QuickBooks ProAdvisor, a CPA, and a Certified Advanced QBO ProAdvisor. I am truly passionate about helping entrepreneurs and bookkeepers to minimize bookkeeping and maximize profits. Let's face it - nobody wants to spend too much time doing bookkeeping! Download chemdraw for mac.

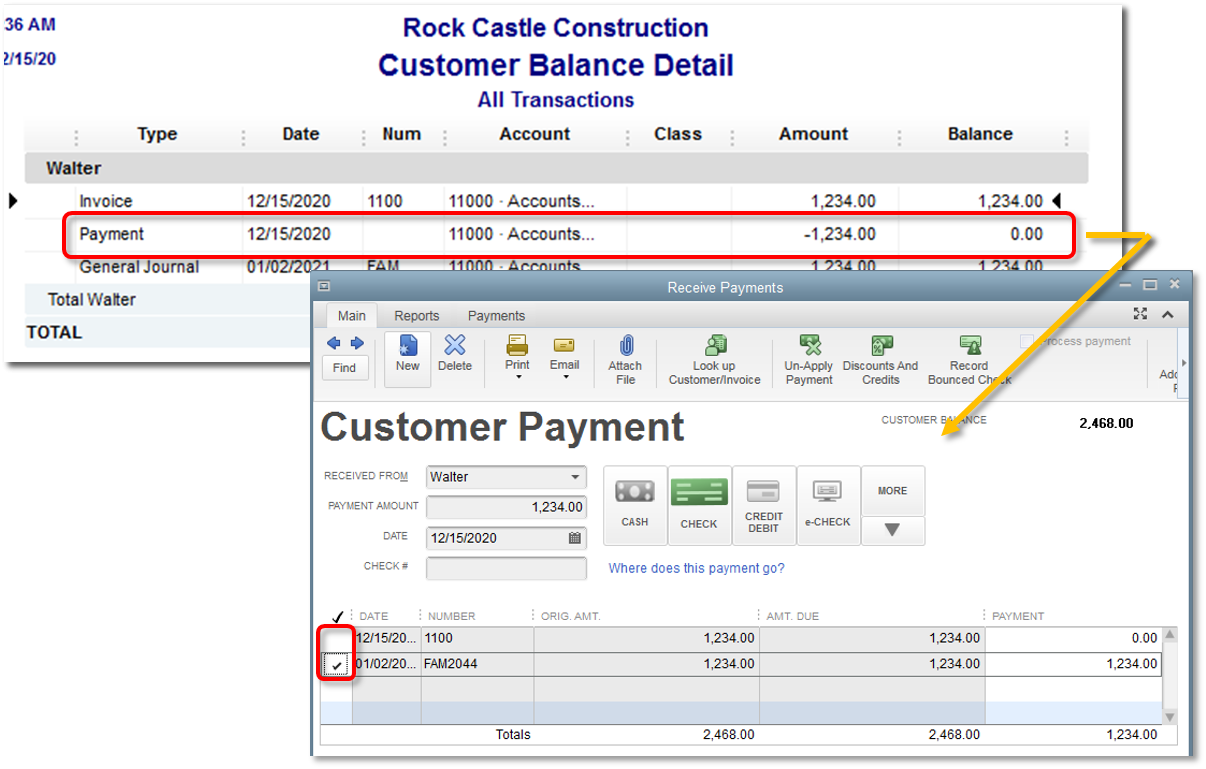

Record the Bounced Check • From your QuickBooks home screen, navigate to Customer Payments and select Receive Payments. • Select Record Bounced Check in the upper right corner of the Receive Payments Screen. Samsung odin download for mac. • Type the customer's name in the Received From field.

(Different Items have to be created for each bank account. Logic is simple. Items link the accounts.) NSF Check (BANK) Fee Item: (for Bank charges) Just like the way NSF Check Item created, crate another Item and name it ‘NSF Check Charges’. (We need to recover charges levied by bank) NSF Check (OUR) Charges Item: (for Company Charges to customer) Now you are an expert in creating Items. Link this item to Income a/c NSF Check Charges SECOND STEP (Needed to do for every NSF check) STEP I ENTER CREDIT MEMO TO NULLIFY ORIGINAL INVOICE IN QUICKBOOKS • Go to Customers>Enter Credit Memo/Refunds>Choose Customer> • Enter all the items entered in original invoice including Sales Tax if any • Choose ‘NSF Check’ Item WITH A NEGATIVE AMOUNT (If NSF check is only part payment of the invoice, please enter only check amount) (Since you have entered original invoice amount and then NSF check as negative amount total of the Credit Memo will be zero.